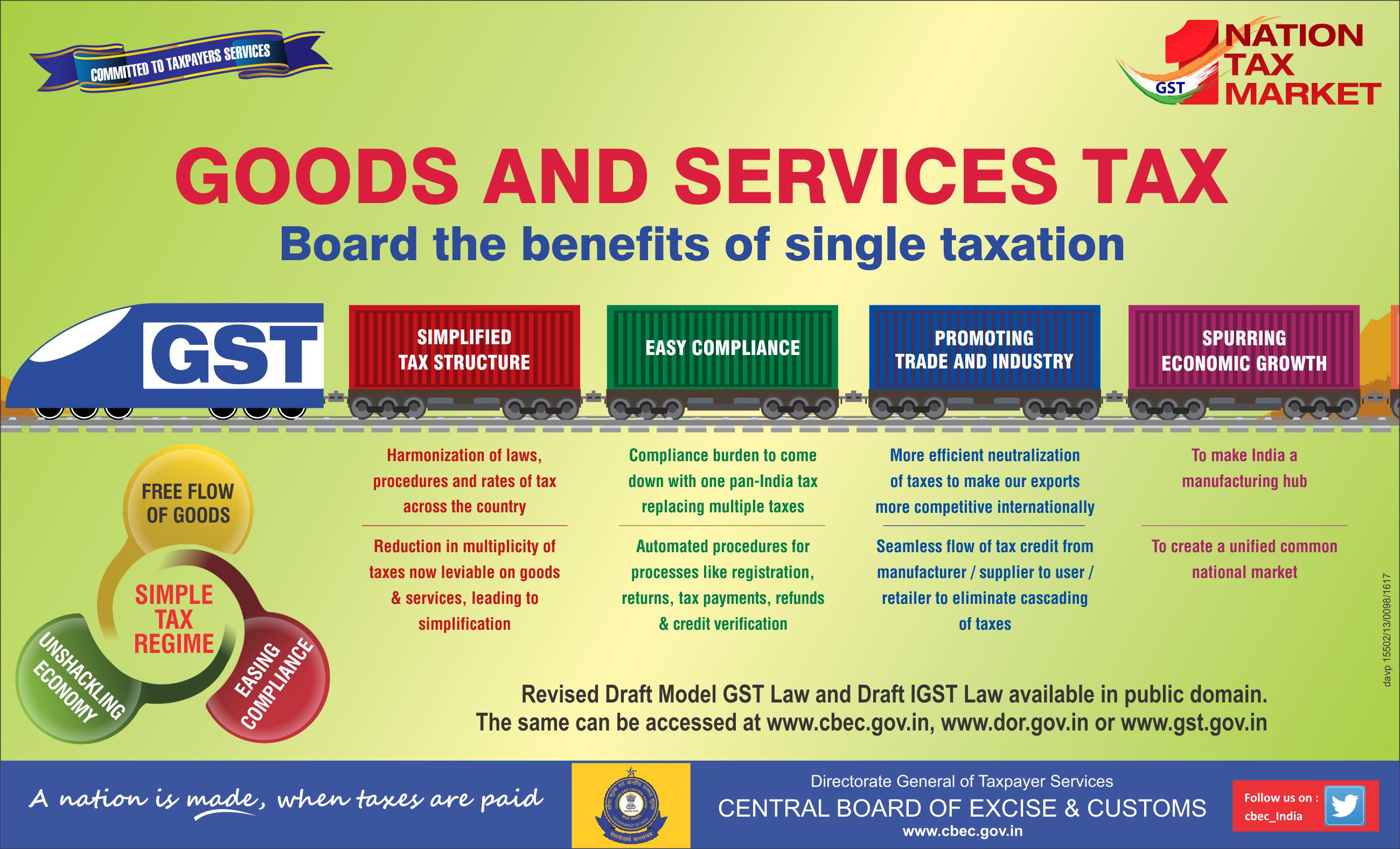

Goods and Service Tax in India

GST Implementation In India

“One country one Type of tax”

GST Implementation in India is expected to be a great step. As GST will bind entire India under a single tax unit. GST is considered India’s biggest tax reformation since India’s independence.

Among 193 countries, more than 160 nations have implemented GST or VAT (Value Added Tax). Basically, GST is based on the rules and regulations of a VAT. In place of all other taxes, GST will be implemented.

About a fifth of the total tax revenue is generated through VAT. Tax revenue is generated through Vat throughout the world and also among the members of the Organization for Economic Co-operation and Development (OECD).

History of VAT (Value Added Tax)

The very nation to implement VAT was France. Though the concept or idea of VAT was first introduced by German industrialist Dr. Wilhelm von Siemens in 1920.

The idea was carried forward by Maurice Laure of France. He was the Joint Director of the France Tax Authority. Maurice Laure is also known as the “Father of VAT”. So in this way, France became the first nation to implement VAT in 1954.

After France, then Germany and Britain were the nations to implement VAT. In this VAT was implemented in all the European nations. Among the nations who are the members of BRICS, Brazil is one such nation to implement VAT in the twentieth century.

GST Implementation In India

With GST in the process, VAT will be a part of history. So it can be said that GST is a modified version of a VAT and with a new name.

This reflects “maturity” of the Indian democratic system as such an important legislation was approved with harmony rather than on the basis of figures. Our Prime Minister Shri Narendra Modi said on the successful passing of the Bill. Modi Ji appreciated the move.

“Great Step by Team India, Great Step towards Transformation, Great Steps towards Transparency, this is GST,” said PM Modi.

There are many things that are associated with this GST. Some are sure to be in an advantageous position. It has been seen many benefits of GST in India.

The biggest challenge for us, citizens understands about GST. GST as said from the beginning is an indirect tax. This tax is going to end all other forms of taxes which are levied by central and state government. It is governed by GST Council and its Chairman, Shri Arun Jaitley, our Union Finance Minister.

Main Points Must Know About Goods and Service Tax (GST) Implementation In India is :

- There are 17 types of taxes and duties which are abolished by GST

- Cascading effect of taxes on Taxes will be ended

- There are three types of Taxes Levied under GST are CGST, SGST, and IGST

- GST will be charged at the point of Sale not at the point of manufacturing like excise and other Taxes Were.

- No need to take GST number if your sale is below 20 lakh in a year. ( 10 Lakh in some special eastern states)

- You can pay composite GST Tax if your sale is up to Rupees seventy-five Lakh rupees.

Must Read for you

Service Tax Rate of GST

There are five Slabs of GST are as follows : 0%, 5%, 12%, 18% and 28%.

With GST in town, it is expected that the states will get to earn more. With the help of GST, there must be a balance between the economy of western and eastern India. The things that will leave an impact on consumers and cause inflation are kept out of GST.

The present scenario of tax is structured under two: – direct and indirect tax. A direct tax is levied on an individual person i.e. it cannot be handed over to another person. The indirect tax which can be handed over to another person. That means if one is liable for that tax he can be handed over to someone else.

Goods and Service Tax India, include all central indirect taxes such as excise duty, other duties, and service tax, as also state charges like VAT, entry tax, luxury tax, and many others.

The billing for large companies runs into crores, including the consultancy services, the smaller companies are eying on volumes with some charging a fee of as low as Rs 100-200 a month for filing returns.

Conclusion

Implementation of GST is intended to leave a tough impact on the Indian economy. This will be lucrative to others won’t be on losses is also assured. Whenever a resolution is approved people comes in action. they hard Think about Profit or loss. There is only some stuff which is going to be costly and many of there which are going to be cheap.

No Comments